Statement of retained earnings explanation, format, example, formula

von Conny17.September 2021

Content

Thus, at 100,000 shares, the market value per share was $20 ($2Million/100,000). However, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000). Thus, stock dividends lead to the transfer of the amount from the retained earnings account to the common stock account. The statement starts with the beginning balance of retained earnings, adds net income (or subtracts net loss), and subtracts dividends paid. The accountant will also consider any changes in the company’s net assets that are not included in profits or losses (i.e., adjustments for depreciation and other non-cash items).

Now, how much amount is transferred to the paid-in capital depends upon whether the company has issued a small or a large stock dividend. To calculate retained earnings, start with the company’s net income figure for the period in question. From there, subtract any dividends that were paid out during that period. This figure can then be added to the retained earnings figure from the previous accounting period.

Statement of Retained Earnings – Explained

When retained earnings are cumulative, it means that the current year’s retained earnings are added to the previous year’s retained earnings. This cumulative total is the sum of all retained earnings since the company was founded. In other words, cumulative retained earnings represent the total amount of all past retained earnings from previous years. This number can provide an idea of how much money has been reinvested back into the business over time. You can expand on the information listed in your statement of retained earnings if you want, such as par value of the stock, paid-in capital, and total shareholders’ equity. Or, you can keep your statement of retained earnings short, sweet, and to the point.

Even though there are adequate profits, companies commonly have limited retained earnings as they distribute most of the funds among the shareholders as dividends. Emphasizing retained earnings becomes necessary if borrowing becomes expensive, even with limited profits. To find your shareholders‘ equity (or owner’s equity) balance, subtract the total amount of dividends paid out from the beginning equity balance.

How do accountants calculate retained earnings?

You can either distribute surplus income as dividends or reinvest the same as retained earnings. This reduction in cashflow statement is also reflected in the cash in the balance sheet. Retained earnings is used to show investors and the market how the business is doing and how much can be reinvested back into its operations or distributed to shareholders. You can find this number by subtracting your company’s total expenses from its total revenue for the period.

- Multiplying that number by your company’s net income will give you the retained earnings balance for the period.

- The reduction of $3.7B mostly came from paying more out in dividends than the company generated in net income.

- Retained earnings can be less than zero during an accounting period — If dividend payments are greater than profits, or profits are negative.

- A company indicates a deficit by listing retained earnings with a negative amount in the stockholders’ equity section of the balance sheet.

- The purpose of the retained earnings statement is to show how much profit the company has earned and reinvested.

- On the balance sheet you can usually directly find what the retained earnings of the company are, but even if it doesn’t, you can use other figures to calculate the sum.

The retention ratio (also known as the plowback ratio) is the percentage of net profits that the business owners keep in the business as retained earnings. The purpose of releasing a statement of retained earnings is to improve market and investor confidence in the organization. Instead, the retained earnings are redirected, often as a reinvestment within the organization.

What Is a Statement of Retained Earnings? What It Includes

The statement of retained earnings is also known as the retained earnings statement, the statement of shareholders‘ equity, the statement of owners‘ equity, and the equity statement. This represents capital that the company has made in income during its history and chose to hold onto rather than paying out dividends. Retained earnings are the cumulative net earnings or profit of a company after paying dividends. Retained earnings are the net earnings after dividends that are available for reinvestment back into the company or to pay down debt.

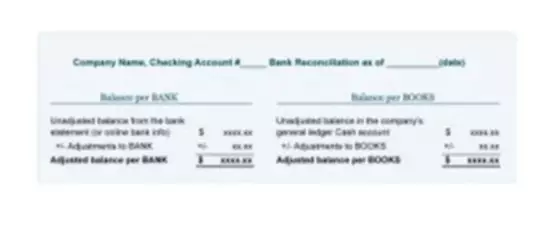

Once you consider all these elements, you can determine the retained earnings figure. To arrive at retained earnings, the accountant will subtract all dividends, whether they are cash or stock dividends, from the total amount of profits and losses. Here is an example of how to prepare a statement of retained earnings from our unadjusted trial balance and financial statements used in the accounting cycle examples for Paul’s Guitar Shop. One reason the statement of retained earnings is important is it helps provide insights into how profitable a company has been over a specific accounting period. Another reason it is important is that it can provide critical information relating to the company’s dividend payout policies. A statement of retained earnings is part of a company’s financial statement, which explains any change in retained earnings during an accounting period.

Step 3: Add Net Income From the Income Statement

Retained earnings are shown is the balance sheet within equity and are equal to the amount of net income left over once you have paid out dividends (distributions) to shareholders. The statement of retained earnings therefore tells you whether your business has made a profit or loss over the period. The statement can also serve a legal purpose in the limiting of treasury stock purchases. Treasury stock is a term typically used to describe the shares of a company that have been repurchased by the company and are held in the company’s treasury. Treasury stock purchases are often limited (by law) based on the amount of retained earnings for a year. Retained earnings can be less than zero during an accounting period — If dividend payments are greater than profits, or profits are negative.

The statement of retained earnings is also known as the statement of owner’s equity, equity statement, or statement of shareholders’ equity. Although the statement of earnings is not one of the main financial statements, it is useful in tracking your business’s retained earnings and seeking outside financing. As a result, the retention ratio helps investors determine a company’s reinvestment rate.

Retained Earnings Build Owner Wealth

Beginning Period Retained Earnings is the balance in the retained earnings account as at the beginning of an accounting period. That is the closing balance of the retained earnings account as in the previous accounting period. For instance, if you prepare a yearly balance sheet, the current year’s opening balance of retained earnings would be the previous year’s closing balance statement of retained earnings example of the retained earnings account. The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders. Nova Electronics Company earned a net income of $1,500,000 for the year 2021.

- Thus, it can be seen that ABC Company’s retained earnings at the end of the year are $125,000.

- Even though there are adequate profits, companies commonly have limited retained earnings as they distribute most of the funds among the shareholders as dividends.

- As an investor, you would be keen to know more about the retained earnings figure.

- Public companies publish and send this report to shareholders before their annual meeting to elect directors.

- That loss, which is a negative profit, would translate to negative retained earnings.

Artikel gespeichert unter: Hochzeits News

Ihr Kommentar

Folgende HTML-Tags sind erlaubt:

<b> <em> <i> <p>

Kommentare als RSS Feed abonnieren